Washington (CNN) -- It's crunch time for avoiding the fiscal cliff as President Barack Obama and House Speaker John Boehner and their aides hold private talks on issues that will impact every American.

Three weeks remain to cut a deal before the automatic tax hikes and spending cuts of the fiscal cliff go into effect on January 1.

Obama and Boehner met face-to-face on Sunday for the first time since November 16. It also was their first one-on-one meeting in more than a year, when talks broke down on a comprehensive agreement to reduce the nation's chronic federal deficits and debt.

In a rare display of bipartisan concurrence, both sides issued identical statements after the meeting that said no details would be forthcoming. Staff on both sides also have been talking, but few details were available.

How will the 'fiscal cliff' affect you?

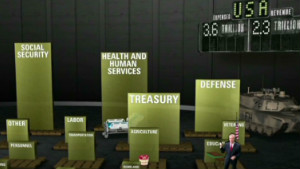

Visualize the fiscal cliff

Visualize the fiscal cliff  iReporters sound off on the fiscal cliff

iReporters sound off on the fiscal cliff  What if we go off the fiscal cliff?

What if we go off the fiscal cliff? "I'm willing to compromise a little bit," Obama said Monday in a campaign-style speech to a Michigan diesel engine plant. However, he continued to insist on higher tax rates on the wealthiest Americans, saying "that's a principle I'm not going to compromise on."

Boehner's spokesman, meanwhile, said the latest Republican offer -- which rejects Obama's call for rates to rise on the highest tax brackets -- remained the GOP position.

The outline for a deal has become clear in recent weeks. Both sides agree that more revenue from taxes should be part of the equation, with Obama seeking $1.6 trillion and Republicans offering $800 billion.

However, Boehner's side wants additional revenue to come from tax reform, such as eliminating some deductions and loopholes, while Obama demands the higher tax rates on income over $250,000 for families as part of the equation.

Boehner and Republicans also seek savings from entitlement programs such as Social Security, Medicare and Medicaid totaling another $800 billion or so, while Obama has proposed $400 billion in reduced entitlement costs. Social Security would not be included.

Another sticky issue -- whether the need to raise the federal debt ceiling early next year should be part of the discussion -- also appears unresolved. Obama says absolutely not, while Boehner says that any increase in the federal borrowing limit must be offset by spending cuts.

It remains unclear if a deal will happen before the end of the year or if the negotiations will carry over into 2013, after the fiscal cliff takes effect.

Read more: Americans already making big decisions over cliff

While economists warn that going over the fiscal cliff could lead to recession, the administration has signaled it can delay some of the effects to allow time to work out an agreement.

Without action now, the nonpartisan Tax Policy Center estimates that middle-class families would pay about $2,000 a year more in taxes. Even with a deal, revisions in the tax code and other changes would mean everyone pays a bit more starting next year.

All signs point toward a two-step approach sought by the newly re-elected Obama.

Fiscal cliff and cost of doing nothing

Fiscal cliff and cost of doing nothing  The fiscal cliff and food safety

The fiscal cliff and food safety  Gross: U.S. needs $16T deficit plan

Gross: U.S. needs $16T deficit plan An initial agreement reached now would extend current tax rates for most people while letting rates return to higher levels of the Clinton era on the two highest income brackets.

Republicans oppose any tax rate hike, so a possible compromise would increase the income threshold for the higher rates to kick in above the $250,000 figure sought by Obama.

Such an agreement would put off the main worry of the fiscal cliff -- expiration of Bush-era tax cuts that would result in higher rates for everyone.

Obama and Democrats say they would then be ready to negotiate significant savings from entitlement programs, while Republicans say they need to first see commitment on entitlement reforms before accepting any higher tax rates.

"The Republican offer made last week remains the Republican offer, and we continue to wait for the president to identify the spending cuts he's willing to make as part of the 'balanced' approach he promised the American people," said Boehner spokesman Michael Steel.

Meanwhile, White House spokesman Jay Carney told reporters that Republicans have failed to fully explain their proposal to increase revenue by $800 billion.

"The president is the only party to put forward a plan with specificity on both the spending and revenue side," Carney said, describing the Republican plan so far as "unnamed closures in loopholes and unnamed caps in deductions."

To move forward, he continued, "Republicans have to recognize that we cannot afford, the public does not support, and it is economically a bad idea to extend tax cuts for millionaires and billionaires and those making over $250,000."

Pressure for some kind of agreement now increases daily.

Some in Congress warn that the legislative process will need two weeks to work through potentially complex measures from any proposed deal, meaning a de facto deadline of Friday may exist for negotiators.

At the same time, voices from inside and outside the process say something must happen now.

On Sunday, International Monetary Fund chief Christine Lagarde echoed numerous economic experts in predicting a sharp drop in confidence and "zero" U.S. economic growth if there's no agreement.

The tax issue was a main November election campaign topic, with Obama saying the wealthiest Americans must pay more and Republicans opposing any tax rate increase.

Four polls in the past two weeks, including a new one released Monday, show that more Americans support Obama's proposal.

From my home to the House: How to fix the fiscal cliff

The Senate has passed a measure that holds down tax rates on income below $250,000 for families, as sought by Obama, while letting rates go up to 1990s levels for higher earners.

Obama and Democrats say House passage of that proposal would clear the way for a broader deal. However, House Republicans refuse to bring it up for a vote amid cracks in the GOP facade against a rate hike.

Sen. Bob Corker of Tennessee said Sunday that he would support raising taxes on the top 2% of income earners, arguing that it will better position Republicans to negotiate for larger spending cuts to Social Security and Medicare despite opposition from many Democrats.

"A lot of people are putting forth a theory, and I actually think it has merit, where you go ahead and give the president ... the rate increase on the top 2%, and all of a sudden the shift goes back to entitlements," Corker said on "Fox News Sunday."

Fellow Republican Sens. Tom Coburn of Oklahoma and Susan Collins and Olympia Snowe of Maine also have said they could vote for such a limited tax hike.

On the House side, Rep. Tom Cole of Oklahoma reiterated Sunday that he could go along with higher rates on the wealthy.

"You have to do something, and doing something requires the cooperation of the Senate, which the Democrats run, and the signature of the president," he said on CNN's "State of the Union."

Meanwhile, conservative colleague Rep. Marsha Blackburn of Tennessee refused to budge from GOP orthodoxy against higher tax rates.

Even though Obama won re-election and Democrats increased their Senate majority while narrowing the Republican majority in the House, she insisted that the November vote showed that voters "clearly said we don't want our taxes to go up."

Opinion: Congress' fiscal moment of truth

{ 0 comments... read them below or add one }

Post a Comment