Washington (CNN) -- Senate leaders argued Thursday over how even to debate a possible fiscal agreement, four days before the deadline for a deal to avoid automatic tax hikes and spending cuts set to take effect in the new year.

The back-and-forth occurred as President Barack Obama and the Senate returned to Washington after a Christmas break, and House leaders announced the chamber would reconvene on Sunday for what will be the final days of the 112th Congress, before a new legislature is sworn in next week.

Republicans insisted on more details about a scaled-back proposal first mentioned last Friday by President Barack Obama, with Senate GOP leader Mitch McConnell saying his side won't "write a blank check for anything Senate Democrats put forward just because we find ourselves at edge of the cliff."

A Senate Democratic leadership member also said more details would be provided, but two White House officials said Obama will not send a fiscal cliff measure to Congress.

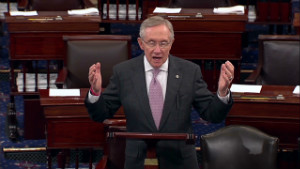

Senate Majority Leader Harry Reid, D-Nevada, argued it was Republicans who undermined an agreement by refusing to compromise on their opposition to higher tax rates for the wealthy.

"We are in same situation we've been in for a long time," Reid said of what he described as GOP intransigence that prevented progress on deficit reduction for the past two years. "We can't negotiate with ourselves."

Economists warn the full impact of the fiscal cliff could spark another recession. In signs of the potential effect, the Consumer Confidence Index sank.

Last week, Obama called for a scaled-back plan that would prevent tax increases on middle-class Americans and extend unemployment benefits.

McConnell told Obama in a telephone conversation Wednesday that he must see details of a proposal before he can figure out any process for a Senate vote.

However, a senior Democratic Senate source told CNN on Thursday that it was McConnell who must first work things out with House Speaker John Boehner on how legislation will proceed before Democrats provide more details of their plan.

Hopes for a so-called grand bargain that would address the nation's chronic federal deficits and debt appeared dashed for now, leaving it to the White House and legislators to work out a less ambitious agreement.

The principal dispute continues to be over taxes, specifically the demand by Obama and Democrats to extend most of the tax cuts passed under President George W. Bush while allowing higher rates of the 1990s to return on top income brackets.

Obama campaigned for reelection on keeping the current lower tax rates on family income up to $250,000, which he argues would protect 98% of Americans and 97% of small businesses from rates that increase on income above that level.

Republicans oppose any kind of increase in tax rates, and Boehner suffered the political indignity last week of offering a compromise -- a $1 million threshold for the higher rates to kick in -- that his colleagues refused to support because it raised taxes and had no chance of passing the Senate.

With House Republicans unable to resolve the impasse, the focus shifted to the Democratic majority in the Senate to come up with a way forward that could pass the House and get signed into law by Obama.

Last Friday, the president proposed the scaled-back agreement that included his call for extending tax cuts on households with incomes under $250,000, as well as an extension of unemployment insurance.

Fiscal cliff fears jolt consumer confidence

Hopes of fiscal cliff deal dwindling

Hopes of fiscal cliff deal dwindling  Days away from fiscal cliff

Days away from fiscal cliff  Fiscal deadline: Ball in Senate's court

Fiscal deadline: Ball in Senate's court  Reid: Boehner running 'dictatorship'

Reid: Boehner running 'dictatorship' Little if any negotation occurred since then, and Reid expressed doubt Thursday that enough time remained to reach an agreement.

"I don't know, time-wise, how it can happen now," he said as he opened the Senate's first session back from the holiday.

fiscal cliff deal fixes a self-inflicted problem

Possible scenarios include a short-term deal now, setting up continued negotiations next year when Obama and a new Congress that convenes in January confront a need to raise the federal debt ceiling and approving further spending to keep the government funded.

Another possibility would be a short-term deal reached after January 1 that would change the political calculus by having legislators vote for cutting the higher tax rates from the fiscal cliff -- a much more palatable exercise than the current debate over allowing top rates to increase.

Opinion: Art that calls the fiscal cliff's bluff

Retiring Republican Rep. Steve LaTourette of Ohio told CNN on Thursday that such an outcome would be entirely due to politics.

"Nobody is willing to pull the trigger" on an agreement because "everybody wants to play the blame game," he said. "This blame game is about to put us over the edge."

Will fiscal cliff hurt the economy?

In his remarks Thursday, Reid said Boehner wanted to wait until after the new House re-elects him as speaker on January 3 before proceeding with a compromise that will need support from Democrats as well as Republicans in order to pass.

Boehner was "more concerned about his speakership than putting the country on firm financial footing," Reid charged.

In response, Boehner's spokesman said Reid should stop talking and instead take up legislation passed by the House that would avert the fiscal cliff.

"The House has already passed legislation to avoid the entire fiscal cliff. Senate Democrats have not," said the spokesman, Michael Steel.

Reid and Democrats reject the GOP proposals, which would extend all the Bush tax cuts and revamp the spending cuts of the fiscal cliff, as insufficient steps that would shift too much of the burden of deficit reduction on the middle class.

Instead, Reid called on Boehner to allow a vote on a Senate-passed measure that would implement Obama's plan to extend tax cuts to the $250,000 threshold. However, McConnell rejected that possibility on Thursday in seeking to focus the debate on revising House-passed measures.

Rep. Nan Hayworth, R-New York, acknowledged Wednesday that a deal will have to include some form of higher rates on top income brackets, but she said her party would fight to make it as minimal as possible.

Hayworth also made clear to CNN that a limited agreement was the most to expect for now, saying: "I don't think we're going to get the big plan in the next six days."

A statement Wednesday by Boehner's leadership team said the Senate must act first on proposals already passed by the House but rejected by Senate leaders and Obama.

"If the Senate will not approve and send them to the president to be signed into law in their current form, they must be amended and returned to the House," the leadership statement said. "Once this has occurred, the House will then consider whether to accept the bills as amended, or to send them back to the Senate with additional amendments. The House will take this action on whatever the Senate can pass, but the Senate first must act."

Obama and Democrats have leverage, based on the president's re-election last month and Democratic gains in the House and Senate in the new Congress. In addition, polls consistently show majority support for Obama's position on taxes.

Americans less optimistic of a fiscal cliff deal

The Gallup daily tracking poll released Wednesday showed 54% of respondents support Obama's handling of the fiscal cliff negotiations, compared with 26% who approve of Boehner's performance.

A senior Senate Democratic source told CNN on Wednesday that Reid has made clear in private conversations that he will need assurance that any plan can pass both the Senate and the House before he will bring it up.

"It is to nobody's advantage to have a failed Senate vote at this point," the source said on condition of not being identified. "This will be the last train we will have, and there is no sense in it leaving the station before we have assurance it will get through."

Remaining questions include whether enough Republicans will support a compromise acceptable to Democrats, and whether McConnell and Senate Republicans will allow a simple majority vote to take up and pass any proposal, or stick to the filibuster level of 60%.

"We believe very strongly a reasonable package can get majorities in both houses," a senior White House official said. "The only thing that would prevent it is if Senator McConnell and Speaker Boehner don't cooperate."

Some Senate Democrats have discussed holding off on bringing up a proposal until the final days of 2012 to increase pressure on Republicans to support avoiding higher taxes on everyone due to the fiscal cliff.

While the focus now is on a possible agreement in coming days or weeks, anti-tax crusader Grover Norquist told CNN this week that the nation should gird for long-range battle.

"It's four years of a fight. It's not one week of a fight," said Norquist, who has threatened to mount primary challenges against Republicans who violate a pledge they signed at his behest against ever voting for a tax increase.

He predicted "a regular fight" when Congress needs to authorize more government spending and raise the federal debt ceiling in coming months.

"There the Republicans have a lot of clout because they can say we'll let you run the government for the next month, but you've got to make these reforms," he said.

On Wednesday, Treasury Secretary Timothy Geithner informed Congress that the government would reach its borrowing limit at the end of the year -- in five days' time -- but could take steps to create what he called "headroom" for two months or so.

Geithner: U.S. to hit debt ceiling on Monday

However, Geithner said uncertainty about the fiscal cliff negotiations and possible changes to the deficit situation made it difficult to predict precisely how long the government's steps to ease the situation would last.

The GOP opposition to any kind of tax rate increase has stalled deficit negotiations for two years and led to unusual political drama, such as McConnell recently filibustering a proposal he introduced and last week's rebuff by House Republicans of the alternative tax plan pushed by Boehner, their leader.

Reid and other Senate Democrats say House Republicans must accept that an agreement will require support from legislators in both parties, rather than a GOP majority in the House pushing through a measure on its own.

Some House Republicans have said they would join Democrats in supporting the president's proposal in hopes of moving past the volatile issue to focus on the spending cuts and entitlement reforms they seek.

The possibility of a fiscal cliff was set in motion over the past two years as a way to force action on mounting government debt.

Now, legislators risk looking politically cynical by seeking to weaken the measures enacted to try to force them to confront tough questions regarding deficit reduction, such as reforms to popular entitlement programs such as Social Security, Medicare and Medicaid.

The two sides seemingly had made progress early last week on forging a $2 trillion deficit reduction deal that included new revenue sought by Obama and spending cuts and entitlement changes desired by Boehner.

Obama's latest offer set $400,000 as the income threshold for a tax rate increase, up from his original plan of $250,000. It also included a new formula for the consumer price index applied to some entitlement benefits, much to the chagrin of liberals.

Called chained CPI, the new formula includes assumptions on consumer habits in response to rising prices, such as seeking cheaper alternatives, and would result in smaller benefit increases in future years.

Statistics supplied by opponents say the change would mean Social Security recipients would get $6,000 less in benefits over the first 15 years of chained CPI.

Liberal groups sought to mount a pressure campaign against including the chained CPI after news emerged this week that Obama was willing to include it, calling the plan a betrayal of senior citizens who had contributed throughout their lives for their benefits.

For his part, Boehner conceded on increased tax revenue, including higher rates on top income brackets and eliminating some deductions and loopholes.

{ 0 comments... read them below or add one }

Post a Comment