Washington (CNN) -- They are losing the battle over higher taxes on the wealthy, so now Republicans are threatening a political war next year when it comes time to raise the nation's debt ceiling.

With cracks appearing in their anti-tax facade and polls showing most Americans favoring President Barack Obama's stance in fiscal cliff negotiations, GOP legislators are starting to advocate a tactical retreat to fight another day.

Conservative Sen. Lindsey Graham, R-South Carolina, promised the newly re-elected Obama a "rude awakening" next year if the president forces through his plan for high-income earners to pay more taxes without agreeing to substantive steps to reduce the nation's chronic federal deficits and debt.

"In February or March, you have to raise the debt ceiling," Graham noted Monday on Fox News. "And I can tell you this: there's a hardening on the Republican side. We're not going to raise the debt ceiling. We're not going to let Obama borrow any more money or any American Congress any more money until we fix this country from becoming Greece."

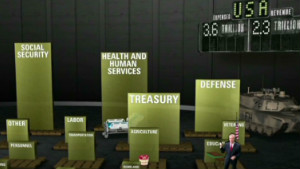

Visualize the fiscal cliff

Visualize the fiscal cliff  Snowe: Fiscal cliff talks a good sign

Snowe: Fiscal cliff talks a good sign  Mayor Cory Booker talks fiscal cliff

Mayor Cory Booker talks fiscal cliff  Chu encouraged by Obama-Boehner meeting

Chu encouraged by Obama-Boehner meeting Another GOP senator, Bob Corker of Tennessee, said his side should give Obama the short-term tax plan he seeks and focus next year on spending cuts and reforming entitlement programs including Social Security, Medicare and Medicaid, as well as broader tax reform.

Survey: 70% want compromise

Three weeks remain to cut a deal before the automatic tax hikes and spending cuts of the fiscal cliff go into effect on January 1.

Without a deal during the current lame-duck session of Congress, everyone's taxes go up and economists warn the impact of the fiscal cliff could cause another recession.

However, the administration has signaled it can delay some of the effects to allow time to work out an agreement when a new Congress convenes in January.

Obama has held a campaign-style series of public events to back his call for extending Bush-era tax cuts for 98% of Americans while allowing rates to return to higher 1990s levels on income over $250,000.

The issue was central to his re-election in November and Obama made clear on Monday that he intended to adhere to his belief that the wealthy must contribute more.

"I'm willing to compromise a little bit," Obama said at a Michigan diesel engine plant. However, he said higher tax rates on the the top income brackets was "a principle I'm not going to compromise on."

The president's public push appears to be working as polls show most Americans back the president's position.

A new Politico/George Washington University survey on Monday said 60% of respondents supported Obama's proposal compared to 38% who opposed it, the latest of four surveys in the past two weeks showing public backing.

On Tuesday, a Gallup poll showed that 70% of adult Americans want Congress and the White House to reach a compromise that would avoid the fiscal cliff. A similar Gallup poll last week said 62% wanted compromise.

The deficit reduction debate hinges on the tax issue, with Republicans opposing any increase in tax rates in their quest to shrink government while Obama and Democrats want to secure more tax revenue as part of a broader package.

Both sides call for eliminating tax deductions and loopholes to raise more revenue, but Obama also demands an end to the tax cuts of 2001 and 2003 for the top brackets.

Republicans oppose the return to higher rates, saying it will inhibit job growth because small business owners declare their profits as personal income and therefore would face a tax increase.

In response, Obama and Democrats note that their plan -- already approved by the Senate and needing only House approval to be signed into law by the president -- affects just 2% of taxpayers and 3% of small business owners.

While Republicans argue those small business owners account for about half of all business income, Democrats say that's because they include law firms, hedge funds traders and other high-income operations.

Obama and House Speaker John Boehner met face-to-face on Sunday for the first time since November 16. It also was their first one-on-one meeting in more than a year, when deficit talks broke down.

The outline for a deal has become clear in recent weeks. Both sides agree that more revenue from taxes should be part of the equation, with Obama seeking $1.6 trillion and Republicans offering $800 billion.

A source close to the talks said Tuesday that the White House had floated the idea of dropping the revenue target to $1.2 trillion, then went up to $1.4 trillion on Monday.

Boehner's side wants additional revenue to come from tax reform, such as eliminating some deductions and loopholes, while Obama demands the higher rates on income over $250,000 for families as part of the equation.

Boehner and Republicans also seek savings from entitlement programs totaling another $800 billion or so, while Obama has proposed $400 billion in reduced entitlement costs. Social Security would not be included in the president's plan.

Another sticky issue -- whether the need to raise the federal debt ceiling early next year should be part of the discussion -- also remains unresolved. Obama says absolutely not, while Boehner says that any increase in the federal borrowing limit must be offset by spending cuts.

Graham's comments Monday showed that Republicans plan to regroup around negotiations to raise the debt ceiling, which allows the government to borrow more money to pay its bills.

He noted that Obama proposed making permanent a process originated by Senate Republican leader Mitch McConnell that would allow the president to increase the debt ceiling and Congress to then try to block it -- an unlikely scenario given Democratic control of the Senate.

"That's going nowhere," Graham said, adding: "He's not king. He's president."

It remains unclear if a deal will happen before the end of the year or if the negotiations will carry over into 2013, after the fiscal cliff takes effect.

Without action now on the fiscal cliff, the nonpartisan Tax Policy Center estimates that middle-class families would pay about $2,000 a year more in taxes. Even with a deal, revisions in the tax code and other changes would mean everyone pays a bit more starting next year.

All signs point toward a two-step approach sought by Obama, with initial agreement now on some version of his tax plan with targets set for comprehensive negotiations on a broader deficit reduction deal in the new Congress next year.

Such an outcome would put off the main worry of the fiscal cliff -- expiration of the Bush-era tax cuts that would result in higher rates for everyone.

Obama and Democrats say they would then be ready to negotiate significant savings from entitlement programs, while Republicans say they need to first see commitment on entitlement reforms before accepting any higher tax rates.

Some in Congress warn that the legislative process will need at least a week to work through potentially complex measures from any proposed deal, meaning a de facto deadline of Christmas Day at the very latest exists for negotiators.

At the same time, voices from inside and outside the process say something must happen now.

{ 0 comments... read them below or add one }

Post a Comment