With the fiscal cliff deal in limbo, what's your New Year's message to Washington? Go to CNN iReport to share your video.

Washington (CNN) -- After exhaustive negotiations that strained the country's patience, the House has approved a Senate bill to thwart a dreaded fiscal cliff.

The 257-167 vote Tuesday night largely fell along partisan lines: 172 Democrats voted yes and 16 Democrats voted no; 85 Republicans voted yes and 151 Republicans voted no.

House Speaker John Boehner was among the Republicans voting for the measure.

Had the House not acted, and the Bush-era tax cuts that were set last decade expired fully, broad tax increases would kick in. In addition, $110 billion in automatic cuts to domestic and military spending would take place.

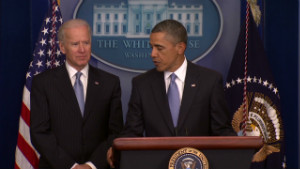

Obama thanks Biden for 'great work'

Obama thanks Biden for 'great work'  Norquist: Fiscal deal not a violation

Norquist: Fiscal deal not a violation  Cole: "The House worked its will"

Cole: "The House worked its will" The combined effect could have dampened economic growth by 0.5%, possibly tipping the U.S. economy back into a recession and driving unemployment from its current 7.7% back over 9%.

"Thanks to the votes of Democrats and Republicans in Congress, I will sign a law that raises taxes on the wealthiest 2% of Americans while preventing a middle-class tax hike that could have sent the economy back into a recession," President Barack Obama said after the House vote.

How they voted: House | Senate

The plan maintains tax cuts for individuals earning less than $400,000 and couples earning less than $450,000. It would raise tax rates for those over those levels -- marking the first time in two decades the rates jump for the wealthiest Americans.

While the deal gives President Barack Obama bragging rights for raising taxes on the wealthiest Americans, it also leaves him breaking a promise.

Obama had vowed to raise tax rates for the top-earning 2% of Americans, including those with household income above $250,000 and individuals earning more than $200,000.

Raising the threshold for higher tax rates to $400,000 shrinks the number of Americans affected.

While nearly 2% of filers have adjusted gross incomes over $250,000, only 0.6% have incomes above $500,000, according to the Tax Policy Center.

But the deal passed by the Senate would cap itemized deductions for individuals making $250,000 and for married couples making $300,000.

Specifics of the deal

According to the deal:

-- The tax rate for individuals making more than $400,000 and couples making more than $450,000 will rise from the current 35% to the Clinton-era rate of 39.6%.

-- Taxes on inherited estates will go up to 40% from 35%.

-- Unemployment insurance would be extended for a year for 2 million people.

-- The alternative minimum tax -- a perennial issue -- would be permanently adjusted for inflation.

-- Child care, tuition and research and development tax credits would be renewed.

-- The "Doc Fix" -- reimbursements for doctors who take Medicare patients -- will continue, but it won't be paid for out of the Obama administration's signature health care law.

-- A spike in milk prices -- dubbed the "dairy cliff" -- will be avoided. Agriculture Secretary Tom Vilsack said milk prices would have doubled to $7 a gallon because a separate agriculture bill had expired.

The Democratic-led Senate overwhelmingly approved the bill early Tuesday morning before passing it to the House.

More fiscal cliffs loom

House Republicans had discussed amending the Senate bill by adding spending cuts. But in the end, House lawmakers voted on the bill as written -- a so-called up or down vote.

The legislation would raise roughly $600 billion in new revenues over 10 years, according to various estimates.

"I'm a very reluctant yes," said Rep. Nan Hayworth, an outgoing Republican representative from New York.

"This is the best we can do given the Senate and the White House sentiment at this point in time, and it is at least a partial victory for the American people," she said. "I'll take that at this point."

The timing of the vote was crucial, as a new Congress is set to be sworn in Thursday.

Payroll taxes still set to go up

Despite the last-minute fiscal cliff agreements, Americans are still likely to see their paychecks shrink somewhat due to a separate battle over payroll taxes.

The government temporarily lowered the payroll tax rate in 2011 to 4.2% from 6.2% to put more money in the pockets of Americans -- but has cost about $120 billion each year. That tax cut expired Monday.

Americans earning $30,000 a year will take home $50 less per month. Those earning $113,700 will lose $189.50 a month.

The proposal laid out by the Senate and approved by the House does not address the sequester, a series of automatic cuts in federal spending. The bill just delays the sequester for two months.

So the deal adds another battle to this year's docket of congressional squabbles over money. The other two: the debt ceiling and a continuing budget resolution.

Obama said he hopes leaders in Washington this year will focus on "seeing if we can put a package like this together with a little bit less drama, a little less brinksmanship (and) not scare the heck out of folks quite as much."

He thanked bipartisan House and Senate leaders for finally reaching an resolution Tuesday, but said Congress' work this year is just beginning.

"I hope that everybody now gets at least a day off I guess, or a few days off, so that people can refresh themselves because we're going to have a lot of work to do in 2013."

Read more: 5 things to know about the fiscal cliff

{ 0 comments... read them below or add one }

Post a Comment